Dream Home

Explore Featured Properties

Cyberjaya Fully furnished condo l 10 mins to MMU & Dpulze Mall l Free all lawyer fees + 0% Downpayment

- MYR 360,000

- Beds: 3

- Baths: 2

- 975 sqft

The Tamarind – Fully Furnished – 1047′ – 1 Car Park – Tanjung Tokong

- MYR 3,100 Monthly

- Beds: 3

- Baths: 2

- 1047 sqft

RENOVATED 2 Storey Terrace @ Laman Delfina, Nilai Impian, Nilai

- MYR 520,000

- Beds: 4

- Baths: 3

- 1953 sqft

Persiaran Cantonment, S/S Bungalow @ Pulau Tikus, Penang

- MYR 10,269,500

- Beds: 6

- Baths: 4

- 4000 sqft

Minden Garden Residence – 3 Stories Terrace – 2600′ – Partly Renovated

- MYR 1,500,000

- Beds: 4

- Baths: 4

- 2600 sqft

Ferringhi Residence – Fully Furnished – 1750′ – 2 Car Parks – Batu Ferringhi

- MYR 2,200 Monthly

- Beds: 3

- Baths: 4

- 1750 sqft

Tropicana 218 Macalister, Georgetown, Penang

- MYR 790,000

- Beds: 2

- Baths: 2

- 683 sqft

Putra Marine Resort, Bayan Lepas, Penang

- MYR 1,530,000

- Beds: 5

- Baths: 5

- 3884 sqft

City Of Dreams, Tanjung Tokong, Penang

- MYR 1,230,000

- Beds: 3

- Baths: 2

- 1185 sqft

10 Island Resort Condo Beach front

- MYR 1,550,000

- Beds: 4

- Baths: 4

- 2400 sqft

Residence 21, Georgetown, Penang

- MYR 2,600,000

- Beds: 4

- Baths: 5

- 5500 sqft

Setia Alam Seri Kasturi Apartment Fully Renovated |For Rent

- MYR 410,000

- Beds: 3

- Baths: 2

- 950 sqft

[Sales – Rm1.38m] 2Sty 32x75sf Semi D BYWATER @ Setia Utama 4, Setia Alam

- MYR 1,380,000

- Beds: 4

- Baths: 4

- 3275 sqft

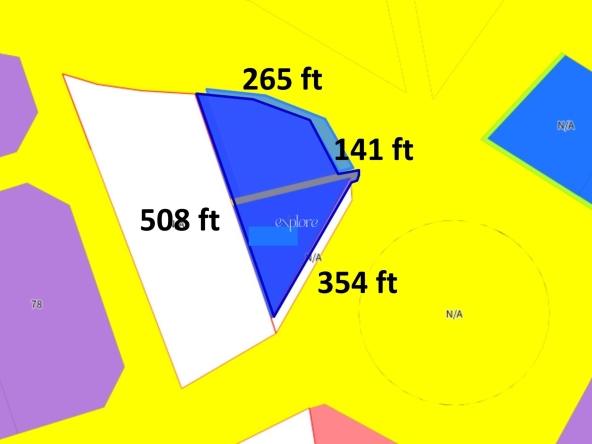

For SALE | Taman Manikar | New Bungalow | CL999 | Likas

- MYR 5,000,000

- Beds: 3

- Baths: 5

- 5653 sqft

Beautiful Bungalow House With Pool Titiwangsa, Kuala Lumpur For Rent

- MYR 14,000 Yearly

- Beds: 5

- Baths: 5

- 7476 sqft

Raffles Residence 199, 3/S Terrace @ Taman Bukit Gambier, Gelugor, Penang

- MYR 1,780,000

- Beds: 6

- Baths: 6

- 3600 sqft

Bandar Botanic Klang 1st Floor Shoplot Klang

- MYR 3,000 Monthly

- 1650 sqft

For SALE | Inanam Capital | Road frontage | CKS Same Row

- MYR 450,000

- 1120 sqft

Completed 2025 l 3R2B only RM1600/Months l Fully Furnished + 0 Downpayment

- MYR 360,000

- Beds: 3

- Baths: 2

- 1000 sqft

Eco Botanic Iskandar Puteri Johor Bahru Johor

- MYR 1,500,000

- Beds: 4

- Bath: 1

- 2970 sqft

The Uban Residence Batu Uban

- MYR 1,200,000

- Beds: 3

- Baths: 3

- 1946 sqft

Corner Lot 2 Storey Superlink House Sejati Lakeside Phase 3 Cyberjaya

- MYR 2,000,000

- Beds: 5

- Baths: 5

- 3032 sqft

The Address Boutique Condominium, Bukit Jambul, Penang

- MYR 850,000

- Beds: 3

- Baths: 3

- 1431 sqft

Double Storey Semi D Sejati Lakeside 2 Cyberjaya Phase 1

- MYR 1,500,000

- Beds: 4

- Baths: 4

- 2407 sqft

3 Storey Shop Office Bandar Baru Kota Puteri, Masai, Johor

- MYR 900,000

- 1539 sqft

Pusat Perdagangan Danga Utama, Johor Bahru

- MYR 1,700,000

- 2210 sqft

Explore Popular Cities

Find your dream neighborhood and explore it with your home purchase advisor. We are here to help you find the perfect home for you.

Explore Home Living Options Tailored for You

From cozy apartments to expansive villas, find a space that feels like home. Begin your journey with our curated listings.

Exclusive on Explore

Search homes for sale in your local area by price, amenities, or other features. We’ll show you the sales history and provide helpful advice.

Shah alam warehouse for sale with ESFR sprinkler

- MYR 180,000,000

- 315300 sqft

Glenmarie temasya 5 sty workshop office & basement car park for sale

- MYR 40,000,000

- 116743 sqft

Bandar Bukit Puchong detached factory for sale with overheard crane

- MYR 28,000,000

- 30000 sqft

Guide for buyers and sellers

Get immediate access to find the best homes for sale, information on market trends, open houses and homes-in-progress.

Agents of the Week

Lee David

Real Estate Negotiator

Li Fang

Property Negotiator

Cheah Alex

Real Estate Negotiator

Explore More

General FAQs

- Buying a Property

- Selling a Property

- Renting a Property

Searching for properties on our website is easy! Just follow these steps:

Go to the Search Bar: At the top of the homepage or on the property search page, you’ll find the search bar.

Enter Your Criteria: Type in keywords related to the property you're looking for, such as location, type of property, or specific features.

Use Filters: To refine your search, use the filters available. You can specify details like price range, number of bedrooms, and amenities.

Click Search: Once you’ve entered your criteria and set your filters, click the search button to view the results.

Browse Listings: Review the search results to find properties that meet your needs. You can click on individual listings for more details.

When buying a property, it's crucial to consider several factors to ensure you make a sound investment. Here’s a comprehensive list:

1. Budget and Financing:*

- Determine Your Budget: Include not just the purchase price but also additional costs like closing fees, taxes, and insurance.

- Get Pre-Approved: Secure mortgage pre-approval to understand your borrowing capacity and strengthen your offer.

2. Location:

- Neighborhood: Research the neighborhood for safety, amenities, and overall vibe.

- Proximity to Essentials: Check the distance to schools, public transport, hospitals, shopping centers, and workplaces.

- Future Development: Investigate any planned developments or zoning changes in the area that might affect property values.

3. Property Condition:

- Inspect Thoroughly: Hire a professional inspector to assess the property’s condition, including structural integrity, electrical systems, plumbing, and appliances.

- Check for Repairs: Look for any immediate repairs or renovations needed and factor these into your budget.

4. Property Features:

- Size and Layout: Ensure the property’s size and layout meet your needs.

- Amenities: Consider features like the number of bedrooms, bathrooms, outdoor space, and any special amenities like a pool or garage.

5. Market Trends:

- Current Market Conditions: Research property market trends in the area to understand pricing and investment potential.

- Historical Data: Look at past property values and market performance to gauge future trends.

6. Legal Considerations:

- Title Check: Verify that the property has a clear title and no legal disputes or liens.

- Regulations and Compliance: Ensure the property meets all local regulations and zoning laws.

7. Resale Value:

- Investment Potential: Consider the property’s potential resale value and how easy it will be to sell in the future.

8. Long-Term Needs:

- Future Growth: Think about how the property will meet your needs in the long term and whether it accommodates any potential life changes.

9. Community and Lifestyle:

- Lifestyle Fit: Assess whether the property and neighborhood align with your lifestyle and preferences.

10. Professional Advice:

- Real Estate Agent: Work with a knowledgeable real estate agent who can provide valuable insights and guide you through the buying process.

- Legal Advisor: Consult a real estate attorney to review contracts and ensure all legal aspects are covered.

For more detailed advice and tips, be sure to check out our comprehensive guide in our blog post [here]

Need Help with Financing Your Property? We’ve Got You Covered!

At Explore, we understand that securing the right financing is a crucial step in your property journey. That’s why we offer comprehensive assistance to help you find the perfect financing solution tailored to your needs. Here’s how we can assist you:

1. Expert Mortgage Brokers:

- Unlock the Best Deals: Our network of experienced mortgage brokers will connect you with top lenders, ensuring you get the best mortgage rates and terms available.

- Stress-Free Process: From application to approval, we streamline the process, so you can focus on finding your dream home.

2. Personalized Financial Advisors:

- Tailored Advice: Our financial advisors will analyze your financial situation and offer personalized guidance to help you choose the best financing options.

- Comprehensive Support: Get expert advice on budgeting, down payments, and managing your finances to make your home-buying experience smooth and successful.

3. Trusted Banks and Lenders:

- Direct Access: Gain access to a range of mortgage products and get pre-approved quickly with our trusted banking partners.

- Competitive Rates: Benefit from competitive interest rates and flexible loan terms designed to fit your financial needs.

4. Dedicated Real Estate Agents:

- Referral Network: Our experienced real estate agents have strong connections with mortgage brokers and lenders.

- Seamless Integration: Get recommendations for reliable financing professionals as part of our full-service real estate experience.

5.*Advanced Online Mortgage Tools:

- Instant Estimates: Use our online calculators to estimate mortgage payments and compare loan options at your convenience.

- Quick Insights: Get a clear picture of what to expect before starting the formal application process.

6. Government Assistance Programs:

- Special Programs: Explore various government programs offering reduced interest rates, lower down payments, and other financial incentives.

- Enhanced Opportunities:Benefit from special programs designed to make homeownership more accessible.

Ready to take the next step? Contact us today to connect with our expert team and find the perfect financing solution for your property needs. Let us help you make your home-buying dreams a reality!

1. Direct Bank Transfer:

- Details: Use the provided bank account details for direct transfers.

- Reference: Include your tenant ID or property address as a reference to ensure proper allocation.

2. Automated Payments:

- Setup: Arrange automatic payments through your bank by setting up recurring transfers.

- Benefits: Ensure your rent is paid on time each month without manual intervention.

3. In-Person Payments:

- Location: Visit our office or designated payment center during business hours.

- Methods: Pay by cash, check, or card at the counter.

4. Mail:

- Address: Send your check or money order to our mailing address.

- Details: Ensure your payment is addressed correctly and includes your tenant ID.

5. Mobile Payment Apps:*

-Options: Pay using popular mobile payment apps if supported.

- Details: Follow the app’s instructions and verify that your payment is directed to the correct account.

Need Assistance?

If you have any questions or need help with the payment process, please contact our office at +60 17-706 1013 or [email protected]. We’re here to assist you!

Starting your property journey is easy with a clear plan. Buyers should first identify their ideal property, set a budget, and obtain mortgage pre-approval. Sellers need to prepare their property, set a competitive price, and market it effectively. Renters should determine their needs and budget before searching for suitable rental options.

For property owners and agents, our CRM portal provides a comprehensive solution for managing property sales. Owners can list their properties, track progress, and receive updates seamlessly. Agents and agencies benefit from our portal by managing multiple listings, accessing real-time data, and coordinating efficiently with clients. This tool simplifies the process for all parties involved.

Once you’ve found the right match, finalize the process by working with professionals to close the sale or lease. For personalized support and expert guidance, reach out to us at +60 17-706 1013 or [email protected] We’re here to assist you every step of the way!

Listing your property for sale is straightforward with our comprehensive process. Start by preparing your property: ensure it is clean, well-maintained, and ready for showings. Gather essential documents such as the property title, recent inspection reports, and any relevant certificates.

Next, utilize our CRM portal to list your property. Simply log in to the portal, enter your property details, upload high-quality photos, and set your asking price. Our portal allows you to manage your listing, track its performance, and receive updates on interested buyers. If you're an agent or part of an agency, you can also manage multiple listings and coordinate with clients seamlessly through the same portal.

Once your listing is live, our team will assist with marketing your property to attract potential buyers. For additional support or to get started, contact us at+60 17-706 1013 or [email protected]. We’re here to assist you! We’re here to help you every step of the way!

To find the value of your property, consider the following steps:

1. Get a Professional Appraisal:

- Hire an Appraiser: A certified appraiser will evaluate your property’s value based on its condition, location, and recent sales of comparable properties in your area.

- Detailed Report: You’ll receive a detailed report outlining your property’s estimated market value.

2. Consult a Real Estate Agent:

- Market Analysis: Real estate agents can provide a Comparative Market Analysis (CMA), comparing your property with similar recently sold properties.

- Expert Insight: They offer insights into current market trends and can provide a competitive price range for your property.

3. Use Online Valuation Tools:

- Automated Estimates: Several online tools and calculators can give you a rough estimate of your property’s value based on recent sales data and market trends.

- Consider Limitations: While useful for initial estimates, these tools might not account for specific details of your property.

4. Check Recent Sales:

- Comparable Properties: Look at recent sales of similar properties in your neighborhood to get an idea of what buyers are willing to pay.

- Adjust for Differences: Consider any unique features or conditions that might affect your property’s value compared to others.

For a precise valuation, especially if you’re looking to sell, it’s best to combine these methods. If you need assistance with the valuation process, contact us at+60 17-706 1013 or [email protected]. We’re here to assist you!

Selling a property involves several costs that can impact your net proceeds. Here’s a breakdown of the common expenses you should consider:

1. Agent Commissions:

- Percentage: Typically, real estate agents charge a commission fee ranging from 5% to 7% of the selling price.

- Details: This fee is usually split between the seller’s and buyer’s agents.

2. Marketing and Advertising:

- Expenses: Costs for professional photography, staging, and listing your property on various platforms.

- Additional: You may also incur costs for brochures, signage, and online advertising.

3. Closing Costs:

- Transfer Taxes: Taxes imposed by local governments on the transfer of property ownership.

- Title Insurance: Protects against any potential disputes over property ownership.

- Attorney Fees: If you hire a lawyer to review contracts and handle legal matters.

4. Repairs and Renovations:

- Preparation: Costs for making repairs or improvements to increase the property’s appeal and market value.

- Inspections: Potential costs for pre-sale inspections to address any issues before listing.

5. Property Taxes and Utilities:

- Prorated Taxes: You may need to pay a portion of property taxes up to the date of sale.

- Utility Bills: Ensure all utility bills are current and paid up to the transfer date.

6. Mortgage Payoff:

- Remaining Balance: Pay off any outstanding mortgage balance upon the sale of the property.

- Prepayment Penalties: Check if there are any penalties for paying off your mortgage early.

7. Other Fees:

- Home Warranty: Optional cost for offering a home warranty to buyers.

- HOA Fees: If applicable, ensure any outstanding Homeowners Association fees are settled.

For a detailed understanding of these costs and to get a precise estimate based on your specific situation, contact us at+60 17-706 1013 or [email protected]. We’re here to assist you!

The time it takes to sell a property can vary based on several factors. Here’s an overview of the typical timelines involved:

Preparation and Listing:

- Preparation: Getting your property ready for sale, including repairs, staging, and gathering necessary documents, can take a few weeks.

- Listing: Once listed, the average time to attract an interested buyer can range from a few weeks to several months, depending on the market conditions and property type.

Negotiation and Offer Acceptance:

- Negotiations: After receiving offers, negotiating terms with potential buyers typically takes a few days to a few weeks.

- Offer Acceptance: The time to accept an offer can vary based on buyer responsiveness and the complexity of the offer.

Closing Process:

- Inspection and Appraisal: The buyer will usually schedule a home inspection and appraisal, which can take a few weeks.

- Closing: The closing process, including finalizing paperwork, securing financing, and transferring ownership, generally takes 30 to 60 days from the time of offer acceptance.

Overall, the entire process from listing to closing can take anywhere from 2 to 6 months, depending on market conditions, property location, and buyer readiness.

For more personalized information or to discuss the selling timeline specific to your property, contact us at +60 17-706 1013 or [email protected]. We’re here to assist you!

Starting your property journey is easy with a clear plan. Buyers should first identify their ideal property, set a budget, and obtain mortgage pre-approval. Sellers need to prepare their property, set a competitive price, and market it effectively. Renters should determine their needs and budget before searching for suitable rental options.

For property owners and agents, our CRM portal provides a comprehensive solution for managing property sales. Owners can list their properties, track progress, and receive updates seamlessly. Agents and agencies benefit from our portal by managing multiple listings, accessing real-time data, and coordinating efficiently with clients. This tool simplifies the process for all parties involved.

Once you’ve found the right match, finalize the process by working with professionals to close the sale or lease. For personalized support and expert guidance, reach out to us at +60 17-706 1013 or [email protected]. We’re here to assist you!

Applying for a rental property involves several key steps to ensure a smooth process. Here’s a straightforward guide to help you:

Find the Right Property:

- Search: Use online listings, contact real estate agents, or visit property management websites to find rental properties that match your needs and budget.

- Viewings: Schedule appointments to view the properties you’re interested in and assess if they meet your requirements.

Prepare Your Application:

- Documents: Gather necessary documents such as proof of income (pay stubs, bank statements), identification (driver’s license, passport), and rental history (previous landlord contact details).

- Application Form: Complete the rental application form provided by the landlord or property management company. This form typically includes personal information, employment details, and references.

Submit Your Application:

- Online or In-Person: Depending on the property, you may be able to submit your application online or in person. Ensure you provide all requested information and documentation.

- Application Fee: Some landlords or property managers may require an application fee to cover the cost of background and credit checks.

Wait for Approval:

- Screening Process: The landlord or property manager will review your application, conduct background checks, and verify your references.

- Follow-Up: Be prepared to provide additional information or documentation if requested. The approval process can take anywhere from a few days to a couple of weeks.

Sign the Lease Agreement:

- Review Terms: Once approved, carefully review the lease agreement, including the rent amount, lease duration, and any rules or policies.

- Sign and Pay Deposit: Sign the lease, pay any required security deposits, and arrange for move-in details.

For assistance with finding a rental property or if you have any questions about the application process, contact us at +60 17-706 1013 or [email protected]. We’re here to assist you!

When applying for a rental property, having the right documents ready can streamline the process. Here’s a list of commonly required documents:

Proof of Income:

- Pay Stubs: Recent pay stubs from your employer, usually from the past 2-3 months.

- Bank Statements: Recent bank statements to demonstrate financial stability.

- Tax Returns: If self-employed, provide your most recent tax returns or 1099 forms.

Identification:

- Driver’s License: A government-issued ID to verify your identity.

- Passport: Alternatively, a passport can be used if you don’t have a driver’s license.

Rental History:

- Previous Landlord Contacts: Contact details of previous landlords for reference.

- Rental Agreements: Copies of previous rental agreements, if available.

Credit Report:

- Credit Score: A copy of your credit report or score may be required to assess your financial responsibility.

Application Form:

- Completed Form: Fill out the rental application form provided by the landlord or property management company.

References:

- Personal References: Contact information for personal or professional references who can vouch for your character.

Application Fee:

- Payment: Some landlords or property managers may require a non-refundable application fee to cover background and credit checks.

Having these documents ready will help speed up the application process and increase your chances of securing the rental property. For assistance with your rental application or any additional questions, contact us at +60 17-706 1013 or [email protected]. We’re here to assist you!

If you’re having trouble making your rent payment on time, it’s important to communicate with your landlord or property manager as soon as possible. Here’s what you should do:

Contact Your Landlord: Reach out to your landlord or property manager immediately to explain your situation. Being proactive can help you avoid late fees and potential legal action.

Provide Documentation: If there’s a legitimate reason for the delay, such as a sudden financial hardship or unexpected expense, provide any necessary documentation to support your case.

Request a Payment Plan: Ask if you can arrange a payment plan to make up the missed rent over time. Many landlords are willing to work with tenants who are facing temporary difficulties.

Explore Assistance Programs: Look into local rental assistance programs or charities that may offer support for tenants in financial distress.

Review Lease Terms: Familiarize yourself with your lease agreement to understand any penalties or grace periods for late payments.

For further assistance or advice on handling rent payment issues, contact us at +60 17-706 1013 or [email protected]. We’re here to assist you!

Paying your rent can be done through various convenient methods. Here’s how you can make your rental payments:

Bank Transfer:

- Direct Transfer: You can transfer the rent amount directly from your bank account to the landlord's or property management company’s bank account. Ensure you use the correct account details provided by them.

Checks:

- Personal Check: Write a personal check for the rent amount and deliver it to your landlord or property manager. Ensure you write the correct amount and include any necessary references or notes.

Money Orders:

- Purchase: Obtain a money order from a bank or post office for the rent amount.

- Delivery: Send or hand-deliver the money order to your landlord or property manager.

In-Person Payments:

- Office Drop-Off: If the landlord or property management office is nearby, you can pay your rent in person during their office hours.

- Receipt: Always ask for a receipt or confirmation of payment for your records.

Mail:

- Postal Service: Mail your payment using a check or money order to the address provided by your landlord or property manager.

- Timing: Ensure to send it well before the due date to avoid late fees.

For further assistance with payment methods or if you have any questions, contact us at +60 17-706 1013 or [email protected]. We’re here to assist you!

Starting your property journey is easy with a clear plan. Buyers should first identify their ideal property, set a budget, and obtain mortgage pre-approval. Sellers need to prepare their property, set a competitive price, and market it effectively. Renters should determine their needs and budget before searching for suitable rental options.

For property owners and agents, our CRM portal provides a comprehensive solution for managing property sales. Owners can list their properties, track progress, and receive updates seamlessly. Agents and agencies benefit from our portal by managing multiple listings, accessing real-time data, and coordinating efficiently with clients. This tool simplifies the process for all parties involved.

Once you’ve found the right match, finalize the process by working with professionals to close the sale or lease. For personalized support and expert guidance, reach out to us at +60 17-706 1013 or [email protected]. We’re here to assist you!