Purchasing your first property is an exciting yet slightly nerve-wracking journey. Here’s why:

- You’ve researched the ideal location with ample amenities (and the neighbors are friendly).

- You’ve created a solid budget that accounts for repayments, savings, and unexpected expenses.

- You’ve chosen the right bank offering a 90% margin of finance with an attractive interest rate.

“Now, everything should be smooth sailing,” you think. But, unfortunately, things can still go wrong!

Before sealing the deal, you may come across some additional “hidden costs” you might have missed, such as:

- Legal fees for the Sale and Purchase Agreement (SPA) and loan agreement

- Real estate agent’s commission

- Stamp duty fees in Malaysia

Understanding these additional costs is crucial when budgeting for your property purchase in Malaysia.

How Can I Find Out What the Rates Are?

To avoid the situation above, it’s essential to familiarize yourself with the list of rates we’ve compiled below. This guide will give you a clear idea of the additional costs you’ll need to budget for. By knowing what to expect, you can avoid being caught off-guard and scrambling to gather funds at the last minute. We’ve got you covered!

Sale and Purchase Agreement, Stamp Duty, and Legal Fees for Buying a Property

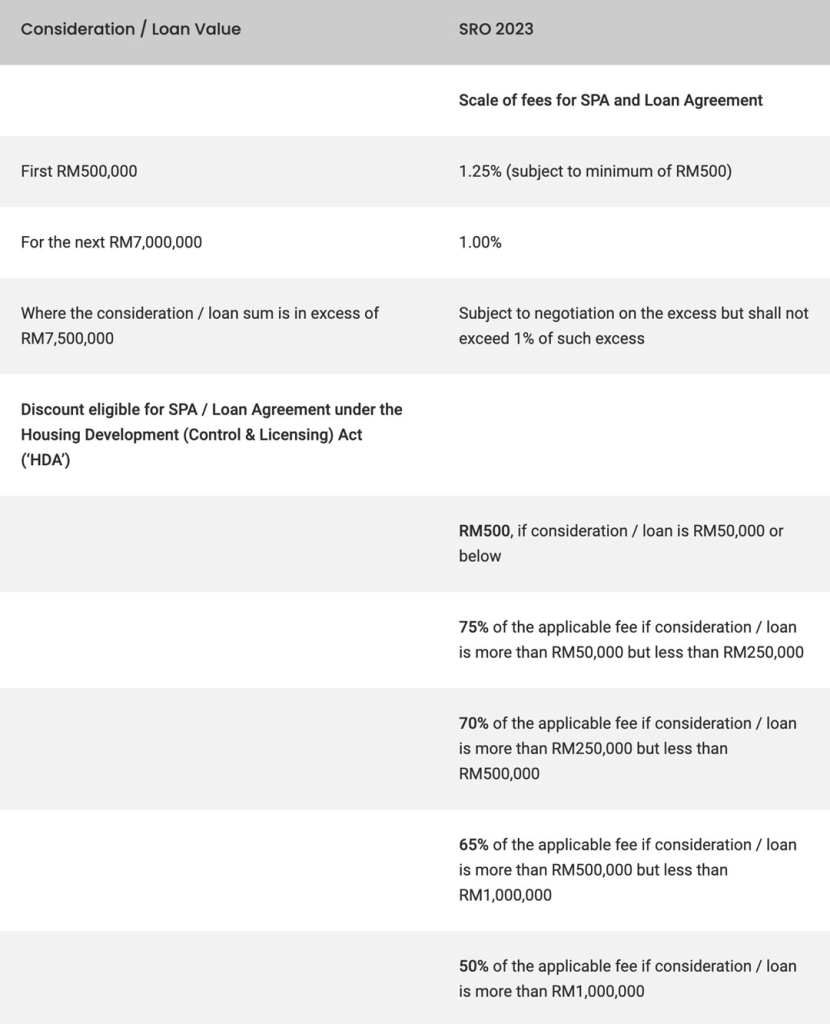

Sale and Purchase Agreement (SPA) Legal Fees 2024

- For the first RM500,000: 1.25% (Subject to a minimum of RM 500)

- For the next RM7,000,000: 1.00%

Legal Fees for Loan Agreement 2024

- For the first RM500,000: 1.25% (Subject to a minimum of RM 500)

- For the next RM7,000,000: 1.00%

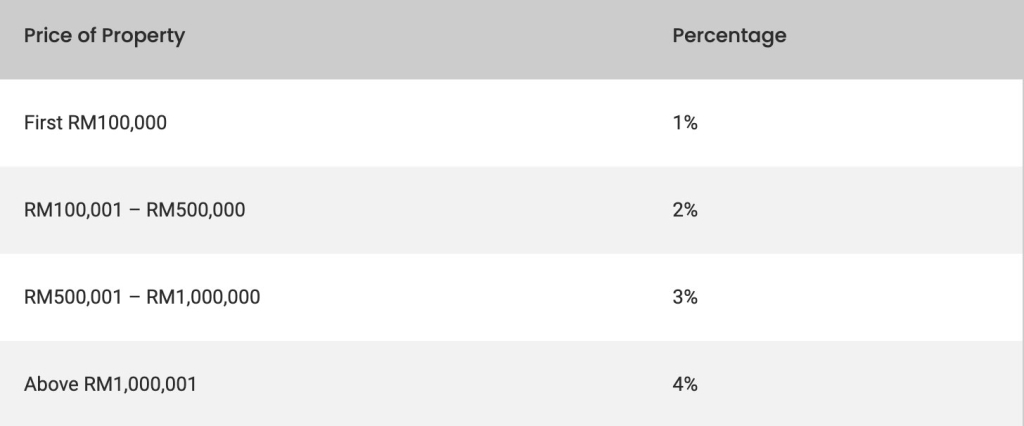

Stamp Duty Fees for Instrument of Transfer 2024

- For first RM100,000: 1%

- For RM100,001 – RM500,000: 2%

- For RM500,001 – RM1,000,000: 3%

- For RM1,000,001 and above: 4%

Stamp Duty Fees for Loan Agreement 2024

- 0.5% of loan amount

What is a Sale and Purchase Agreement (SPA)?

A Sale and Purchase Agreement (SPA) is a legally binding contract between the seller and buyer that specifies the terms and conditions of the transaction, including the property price and key details that the buyer must be aware of. Since the SPA represents a mutual agreement, it cannot be renegotiated or amended after signing, and canceling it typically incurs a penalty of 10% of the purchase price. It’s crucial to thoroughly understand the agreement before signing.

The SPA also includes important details such as the payment schedule, defect liability period, property plans, vacant possession terms, and various other clauses.

What Is Stamp Duty?

Stamp duty, often referred to as a transactional tax or fee, is applied to the stamping of transactional documents such as loan agreements, tenancy agreements, and property transfer documents, including the Sale and Purchase Agreement (SPA).

It is a legal requirement to have the SPA stamped within 30 days of signing. Failing to do so may result in a penalty ranging from 5% to 20% of the unpaid duty.

How To Calculate Stamp Duty Fees

For Instrument of Transfer – Memorandum of Transfer (MOT) or Deed of Assignment (DOA):

For example, the purchase of a property worth RM500,000 would put you in the first two tiers, hence, 1% of RM100,000 and 2% of RM400,000.

- 1% of RM100,000 = RM1,000

- 2% of RM400,000 = RM8,000

- Total stamp duty fees: RM9,000

Stamp duty also applies for loan agreements, but it is capped at a maximum rate of 0.5% of the full value of the loan.

By purchasing an RM500,000 property with a 90% loan (since 10% of it will be the down payment), the loan amount would be RM450,000.

0.5% x RM450,000 = RM2,250 total stamp duty fees

What Are Legal Fees?

Legal fees are an essential component of the Sale and Purchase Agreement (SPA), covering the cost of engaging legal services for a property purchase. While the solicitor is usually appointed by the seller, buyers have the option to select their own legal representative if preferred.

In some cases, developers may opt to cover the legal fees to ease the financial burden on buyers.

How To Calculate Legal Fees in 2024

The new legal fees has been implemented on 15th July, 2023 as below.

For a property bought at RM500,000 under HDA, the legal fees would be:

Stamp Duty Exemption For Your First Home

During the tabling of Budget 2023, the Malaysian government announced stamp duty exemptions for first-time homebuyers!

The full stamp duty exemption will be given to both instruments of transfer and loan agreement for the purchase of a first home worth RM500,000 and below until 2025.

Yup, that means it’s full exemption for the stamp duty on both instrument of transfer and loan agreement if your property price is RM500,000 and below!

That’s a maximum of RM11,250 savings! The detailed calculation as follows:

[(First RM100,000 x 1%) + (Next RM400,000 x 2%)] + 0.5% of loan amount, assuming 90% of property price (RM450,000)

= (RM1,000 + RM8,000) + (0.5% x RM450,000)

= RM9,000 + RM2,250

= RM11,250

Disclaimer: The information provided is for general informational purposes only. Explore Malaysia Sdn Bhd makes no representations or warranties regarding the accuracy or suitability of the information, including but not limited to any implied warranties of fitness for a particular purpose, to the fullest extent permitted by law. While every effort has been made to ensure the accuracy, reliability, and completeness of the information at the time of writing, it should not be relied upon for making financial, investment, real estate, or legal decisions. This information is not a substitute for professional advice tailored to your specific circumstances. Explore Malaysia Sdn Bhd accepts no liability for any decisions made based on this information.