Understanding a property’s market value is crucial when buying or selling real estate in Malaysia. Whether you’re an investor, homeowner, or first-time buyer, knowing how to evaluate a property’s market value helps you make informed decisions and avoid overpaying or undervaluing your assets.

The Importance of Property Market Value in Malaysia

Property market value refers to the estimated price a property would sell for under fair market conditions. It takes into account various factors like location, demand, and physical condition. Evaluating this accurately is essential for ensuring you get a fair deal, whether you’re negotiating with sellers or applying for bank loans.

Malaysia’s real estate market is dynamic, with regional variations in property prices. For instance, properties in Kuala Lumpur typically differ in value compared to those in smaller towns. Understanding these nuances ensures that your assessment aligns with the local context.

Factors That Influence a Property’s Market Value

When evaluating a property’s market value, consider these key factors:

- Location and Accessibility

Properties in strategic areas with good transportation links, proximity to schools, and access to amenities generally command higher market values. A property close to the MRT or LRT stations in Klang Valley, for example, is often more desirable. - Property Condition and Age

Newer properties or those that are well-maintained typically have higher market values. Conversely, older or poorly maintained buildings may require renovation, which could affect their value. - Market Demand and Trends

The demand for property in a specific area can significantly influence its market value. Regions with booming industries or development projects tend to see an upward trend in prices.

Steps to Evaluate a Property’s Market Value

If you’re planning to evaluate a property’s market value in Malaysia, follow these steps:

- Research Comparable Properties

Look at recent transactions of similar properties in the same area. Platforms like iProperty or Brickz can provide insights into market trends. - Engage a Professional Valuer

Licensed valuers assess property value based on industry standards. They provide reliable estimates that are often required by banks for financing purposes. - Consider the Cost Per Square Foot

Divide the total property price by its built-up area to get the cost per square foot. Compare this with similar properties to see if it aligns with the market. - Account for Additional Costs

Don’t forget to factor in costs like legal fees, stamp duty, and renovation expenses. These can influence the total value of your investment.

Using Online Tools to Evaluate Market Value

Several online resources can help evaluate a property’s market value quickly:

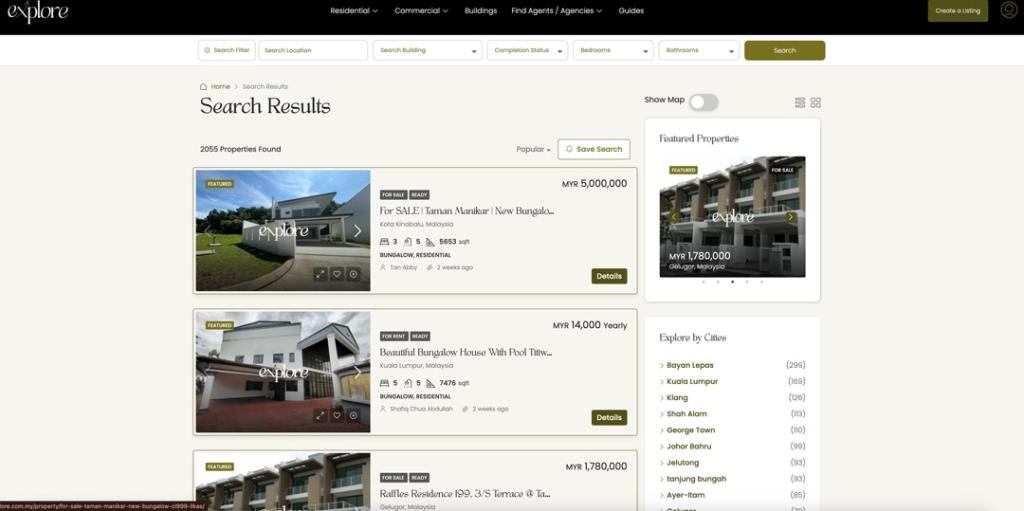

- Real Estate Portals: Websites like PropertyGuru provide listings and historical transaction data.

- Government Databases: The National Property Information Centre (NAPIC) offers detailed market reports and statistics. Visit NAPIC’s website for official information.

- Bank Loan Calculators: Many banks in Malaysia have property loan calculators that estimate the property’s affordability and market range.

Common Mistakes to Avoid

While evaluating property market value, avoid these pitfalls:

- Relying Solely on Online Estimates

Online tools provide general estimates but may not reflect local nuances like road conditions or neighborhood reputation. - Overlooking Future Developments

Nearby upcoming projects like highways or shopping malls could drastically impact property values. Neglecting these can lead to inaccurate evaluations. - Ignoring Zoning and Land Use Restrictions

Be aware of zoning laws and land-use restrictions that could affect the property’s potential. Details about this can be found on the Malaysian Department of Town and Country Planning (PLANMalaysia) website: PLANMalaysia.

Why Engage a Licensed Property Valuer?

Licensed property valuers bring expertise and tools that ensure an accurate assessment. They consider a broader range of factors, such as macroeconomic indicators, which the average buyer might overlook.

Additionally, reports by professional valuers are often required by financial institutions for loan approvals. These reports ensure your property aligns with the bank’s risk assessment criteria.

Final Thoughts

Evaluating a property’s market value in Malaysia is a skill every buyer or seller should develop. Understanding key factors like location, condition, and demand ensures you’re making sound financial decisions. Take advantage of online tools, professional services, and government resources to perform a thorough evaluation.

If you’re ready to explore properties or need professional guidance, contact Explore Malaysia. Let us help you find your dream property with confidence.